Managing personal finances can be a daunting task for many people. With so many expenses and financial goals to consider, it can be challenging to figure out how much to allocate for each one. Fortunately, there’s a simple yet effective rule that can help us achieve financial empowerment—the 50-30-20 rule!

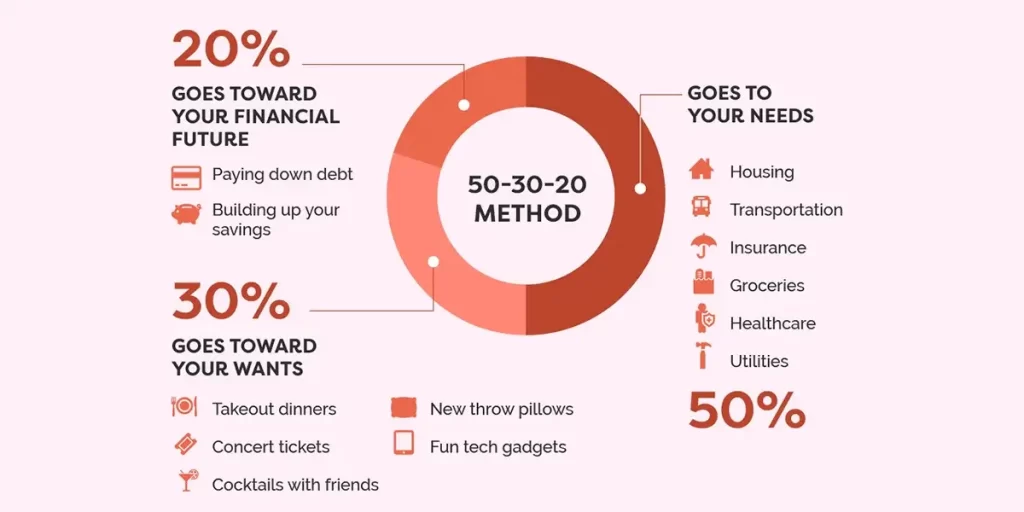

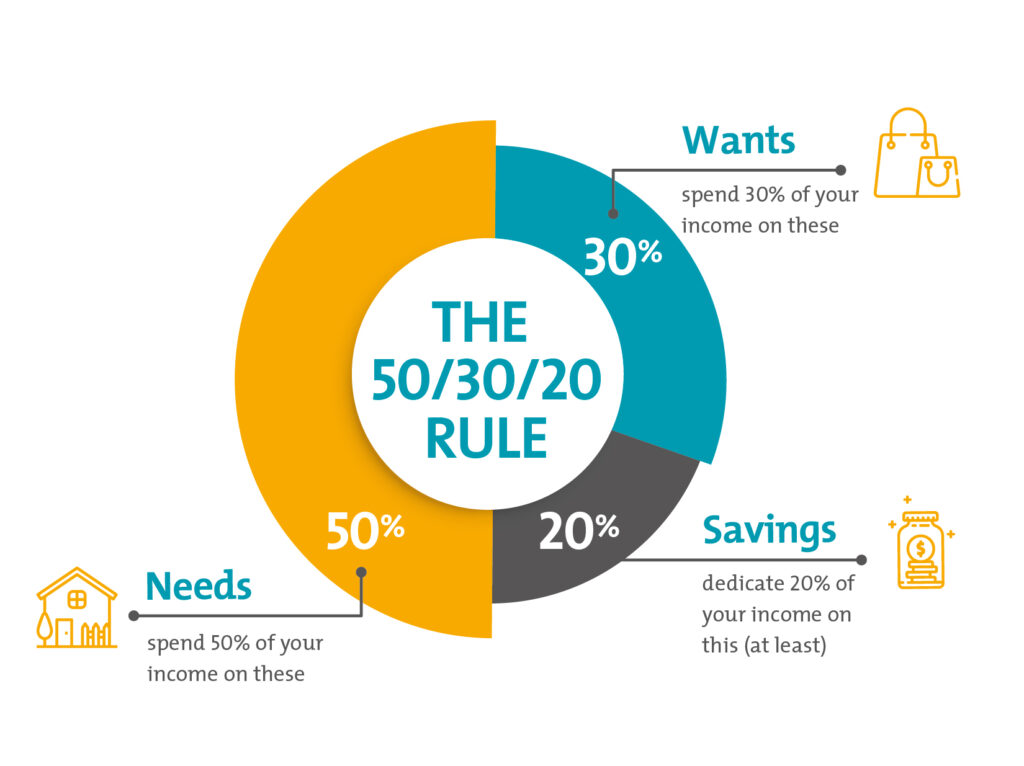

What’s the 50-30-20 Rule? The 50-30-20 rule breaks down your income into three categories, making it easier to allocate your money wisely:

50% for Needs: Think essentials – your housing, utilities, transportation, groceries, insurance, and those unavoidable minimum debt payments. These are the non-negotiables that keep your life ticking.

30% for Wants: Yes! the things that bring color to life! This category covers eating out, entertainment, shopping beyond the basics, and those delightful little treats that make your heart sing.

20% for Savings and Goals: Here comes the exciting part and the essential category! Allocate 20% of your earnings to savings and investments. But wait, it’s not just an emergency fund. This category is also about fueling your dreams – whether a down payment on a car or a house, that dream vacation, or stepping into a new business venture. This helps you build a financial cushion for emergencies and achieve your long-term financial goals.

How to Implement the 50-30-20 Rule in Your Life?

- Track your income and expenses.

- Calculate your after-tax income.

- Allocate your income into three categories using the 50-30-20 rule.

- Adjust your budget as needed to stay on track.

Benefits of the 50-30-20 Principle

- Helps you prioritize your expenses.

- Encourages savings and debt repayment.

- Provides a clear budgeting strategy.

The brilliance of the 50-30-20 rule is in its balance. It lets you relish the present while safeguarding your future. It’s a reminder that your financial journey encompasses all your wants, needs, and aspirations.

Whether you’re already practising this rule or looking to incorporate it into your life, it’s a valuable tool for financial success. Remember, it’s not a rigid formula; it’s your adaptable tool for a vibrant financial future. Here’s to empowering ourselves with the knowledge and tools to make our financial future as vibrant as our dreams! 🚀💪

Is the 50-30-20 rule already something you practice, or do you want to incorporate into your life? Let’s discuss it!

Share your thoughts, experiences, and questions in the comments below. 💬💡

Remember, this rule isn’t a rigid formula; it’s an adaptable tool for financial success. Here’s to empowering ourselves with the knowledge and tools to make our financial future as vibrant as our dreams! 🚀💪

#PersonalFinance #Budgeting #Savings #FinancialEmpowerment #MoneyMatters #50_30_20Rule #SmartMoney #FinancialWellness

Oi, mate! Felt like treatin’ myself, so I signed up for f8betvip‘s VIP program. The perks are alright – faster withdrawals and a dedicated account manager. Their customer service is pretty responsive too. If you’re a high roller, this might be your jam.

vardenafil beste wirkung levitra kur levitra generique

fr8v9r

l85wrt